Some are secured credit cards that require a security deposit to open, but it's better to pay a deposit you can get back than an annual fee that you won't. Several of these cards are aimed at people who are rebuilding their credit, but you can find credit cards for bad credit that don't charge any fees. With limited benefits and costly fees, Credit One Bank credit cards don't make sense no matter what your credit score is.

Its cards for rebuilding credit has even worse cash back rates. Those are two of Credit One Bank's top cards for earning rewards, and they're for consumers with average-to-excellent credit. And you won't even earn 1% back on everything else. purchases in only a few spending categories. It offers 2% back, which would be great if it applied to everything, but it's only on "eligible purchases" - i.e. There's also the Credit One Bank Platinum Rewards Visa with No Annual Fee. The problem is that this card costs $95 per year. That rate is similar to what some of the best no-annual-fee cards offer. On all other purchases, it earns 1% back. It earns 5% cash back on your first $5,000 of eligible purchases per year in select spending categories. The Credit One Bank Platinum Rewards Visa is a good example. Mediocre rewards (at best)Ĭredit One Bank's cards do offer cash back, but their cash back rates are low compared to their annual fees and credit score requirements.

Credit One credit cards don't help with that, and that's a major flaw since their main appeal is how easy they are to get.

When you're rebuilding your credit, it's important to minimize the amount you spend on fees. Credit One Bank doesn't always charge this, so it's likely done on a case-by-case basis.

#Credit one bank login bill payment plus

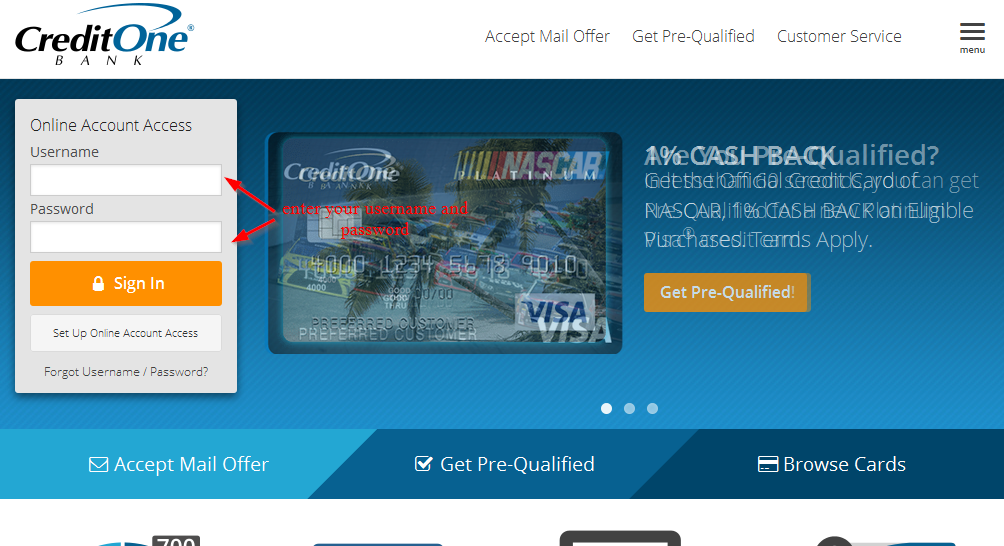

You enter some personal information, Credit One Bank runs a soft credit check (which doesn't affect your credit), and then it will show you which cards you prequalify for, plus the official terms and conditions. To apply for a card, you first need to go through the prequalification process. In the second year, the fee might also be charged annually or broken down into 12 monthly payments. For example, one card lists its annual fee as anywhere from $0 to $95 in the first year, and from $0 to $99 after that. You can view terms upfront for some of its cards, but on others, the information available online is for informational purposes only and can be very broad. Credit One Bank operates much differently. Most credit card companies let you view the terms and conditions of all their cards and apply for any card you want. There are several big flaws that make Credit One Bank one to avoid. Unfortunately, just because it's relatively easy to get one of these cards doesn't mean it's a smart choice. At first glance, a Credit One credit card could seem like a good deal, especially if you already have a mailer saying you're prequalified.

0 kommentar(er)

0 kommentar(er)